“Nationwide, housing unaffordability remains the key challenge facing both renters and homeowners, and solutions are desperately needed,” according to a new report from the Joint Center for Housing Studies (JCHS). On June 20, Harvard University published its annual update regarding the status of country’s housing, The State of the Nation’s Housing 2024. This year’s report reviewed the housing market and demographic drivers of housing before taking a deeper dive into the topics of home ownership, rental housing and housing challenges. This 48-page report is a useful barometer in primary trends and themes of housing affordability.

Housing is Increasingly Unaffordable and Out of Reach for Many

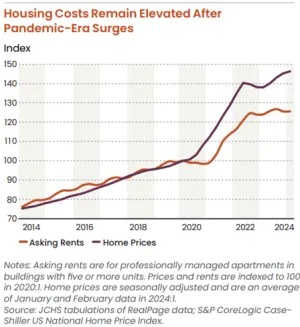

The report examines the affordability crisis surrounding the nation’s housing, pointing to all-time high home prices, elevated interest rates and increased insurance premiums. Even a quick glance reveals that housing costs are increasingly out of reach, with home prices up 5.6% in 2023 and 47% since the beginning of 2020 while rents remain high, up 26% since 2020 (28% in the South region that includes North Carolina). JCHS’s figure below shows the increase in indexed asking rents and home prices from 2014 compared to the most currently available data.

Beyond the increase in home prices, mortgage payments also became an increasingly difficult hurdle for homeowners across the country. Mortgage interest rates currently hover around 7% (after peaking at about 7.8% in 2023) both increasing the amount new home buyers have to pay and also creating a “lock-in effect” for those who obtained mortgages at significantly lower rates. These homeowners who are “locked-in” are reluctant to move out of homes, limiting available for-sale inventory. Due to these constraints and others, existing homes available for sale rests at a minimal 3.2-month housing stock.

Affordable units for rent are far and few between as well. Across the country, there is a shortage of low-rent units with almost all states losing at least 10% of their low-rent units and about half of the states losing more than 20%, North Carolina included. As JCHS reports, “Among the hardest-hit states were those previously considered more affordable that have seen swiftly growing rental demand, including Texas, North Carolina, and Georgia.”

Residents are Increasingly Cost Burdened by Monthly Housing Costs

Monthly housing costs are at an all-time high. For homeowners, the monthly mortgage payment with taxes and insurance for a median-priced home surpassed $3,000 in 2023. For renters, rents have increased 21% since 2001 while incomes have only increased 2% (both figures adjusted for inflation). Renters making less than $30,000 annually are left with only an average of $310 after paying rent. Consequently, as the report states, “high housing costs are forcing financially vulnerable renters to reduce their spending in areas critical to well-being.”

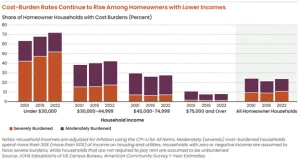

These high housing costs are causing more people to be housing cost burdened (paying more than 30% of their income towards housing costs) and severely burdened (paying more than 50%). In 2022, the most recent data available, the proportion of people who were housing cost burdened increased for both homeowners and renters. For renters, this cost burden increase exists across all income levels as shown in the figure below.

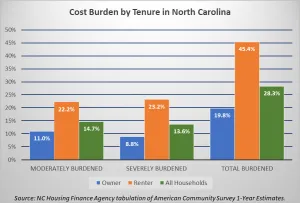

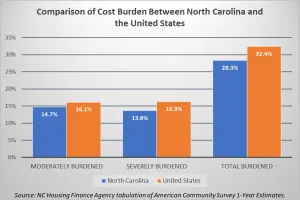

North Carolina’s proportions of cost-burdened households are slightly lower than the national averages, yet the totals remain high. Overall, cost-burdened households across the country are forced to decide between paying their housing expenses or paying for critical needs such as food and healthcare. Worse, many are unable to afford housing altogether. The figures below show the proportion of residents who are either moderately or severely cost burdened as well as provide the combined total of residents who are cost burdened.

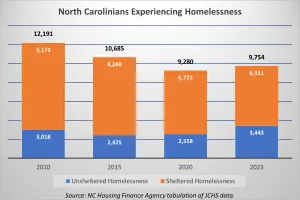

Nationally, the Point-in-Time Count reported about 653,000 people experiencing homelessness, including both those in shelters and those who were unsheltered, on one night in January. This set a record high, even higher than during and immediately following the Great Recession. In addition, the number of unsheltered people experiencing homelessness also hit a record high and had increased by 48% since 2015. While North Carolinians experiencing homelessness was not at an all-time high, the total number of people experiencing homelessness was higher than in 2020, driven by an almost 1,000-person increase in the unsheltered population.

The Outlook Moving Forward

No effort, policy or solution stands alone in trying to address the United States’ or North Carolina’s housing needs. The Report suggests a number of efforts needed to improve access to affordable housing, including increasing the amount of supply, diversity and use of alternative construction methods of low-cost units; increasing assistance programs to lower income renters and homeowners; and bolstering programs addressing housing-related areas such as accessibility, homelessness and building regulations.

Ultimately, access and availability of affordable housing is an ever evolving, complex and interwoven policy arena. More, the best approach for one state, town or community may not the best approach for another.

Read the full report and access additional resources at State of the Nation’s Housing 2024. Learn more about the NC Housing Finance Agency’s programming and resources on its website.

**While we work on updating the graphics above, use this PDF for better formatting.